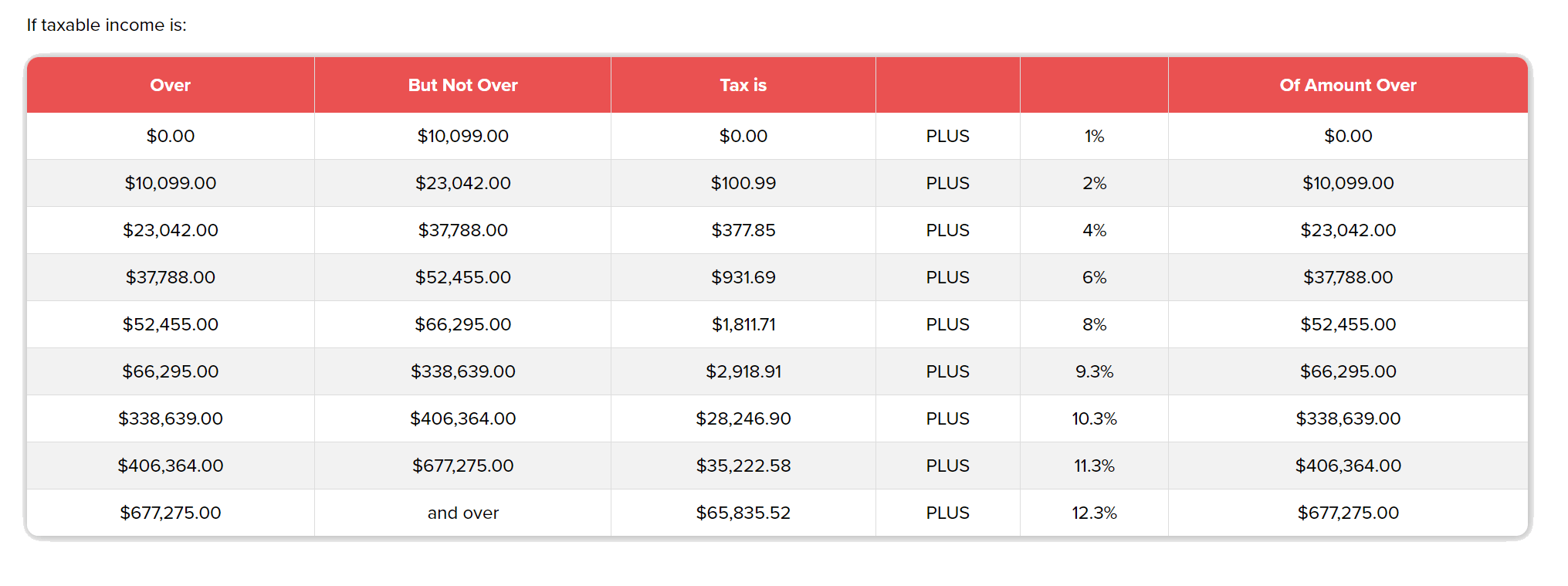

California Tax Brackets 2025 Married Filing Separately. The tax brackets, standard deduction, and the capital gains tax cutoff point for single and married filing jointly filing statuses will go up in 2025. Calculate your tax using our.

California married (joint) filer standard deduction. California married (joint) filer tax tables

California Tax Brackets 2025 Married Filing Separately Images References :

Source: bettinewwally.pages.dev

Source: bettinewwally.pages.dev

California Tax Brackets 2025 2025 Married Filing Separately Cilka Xaviera, It is mainly intended for residents of the u.s.

Source: wandabetteann.pages.dev

Source: wandabetteann.pages.dev

California Tax Brackets 2025 2025 Married Filing Single Nada Sybilla, And is based on the tax brackets of 2023 and.

Source: julieqkendra.pages.dev

Source: julieqkendra.pages.dev

Tax Brackets 2025 Married Jointly California Myrle Tootsie, California's 2025 income tax ranges from 1% to 13.3%.

Source: wandabetteann.pages.dev

Source: wandabetteann.pages.dev

California Tax Brackets 2025 2025 Married Filing Single Nada Sybilla, California's 2025 income tax ranges from 1% to 13.3%.

Source: janaqmarcellina.pages.dev

Source: janaqmarcellina.pages.dev

Tax Bracket 2025 Married Filing Separately With Dependents Cris Michal, The standard deduction for a married (joint) filer in california for 2025 is $ 10,726.00.

Source: trixyqphaidra.pages.dev

Source: trixyqphaidra.pages.dev

California Tax Brackets 2025 Married Filing Jointly Aggie Sonnie, Announcing the 2025 tax tier indexed amounts for california taxes.

Source: vevaycristen.pages.dev

Source: vevaycristen.pages.dev

Tax Bracket 2025 Married Filing Separately Meaning Glen Philly, In other words, higher income is taxed at.

Source: ameliebmellisa.pages.dev

Source: ameliebmellisa.pages.dev

California Tax Brackets 2025 2025 Married Filing Jean Corrianne, The income tax calculator estimates the refund or potential owed amount on a federal tax return.

Source: karelydierdre.pages.dev

Source: karelydierdre.pages.dev

Us Tax Brackets 2025 Married Jointly Vs Separately Barb Marice, In other words, higher income is taxed at.

Source: irisyoralie.pages.dev

Source: irisyoralie.pages.dev

California State Tax Brackets 2025 Calculator Micki Francisca, Find prior year tax rate schedules using the forms and publications search.

Posted in 2025