Federal Tax Brackets 2025. Taxable income and filing status determine which federal tax rates apply to. Simply enter your taxable income and filing status to find your top tax rate.

Changes to marginal tax rates and brackets, itemized deductions, tax exemptions, credits, and other portions of the federal tax system are set to expire at the. The top tax rate is 37% for returns filed by individual taxpayers for the 2024 tax year, which are filed in 2025.

Changes To Marginal Tax Rates And Brackets, Itemized Deductions, Tax Exemptions, Credits, And Other Portions Of The Federal Tax System Are Set To Expire At The.

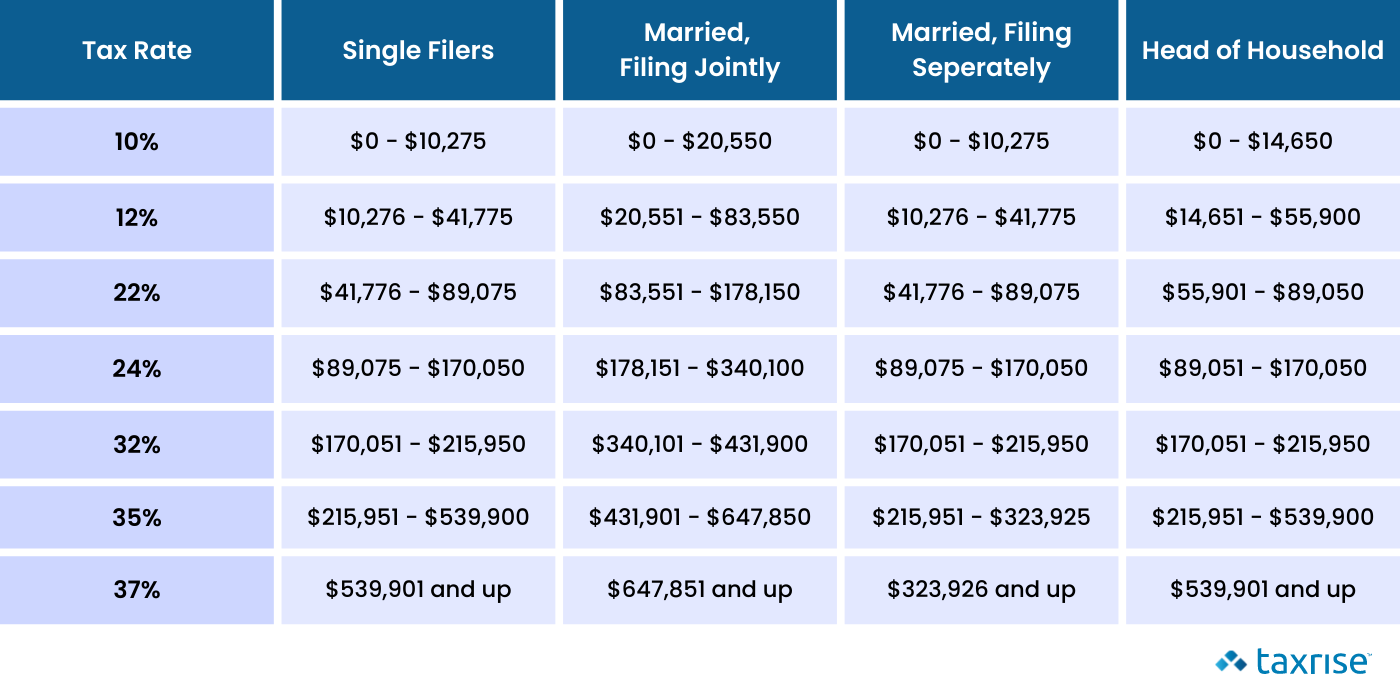

There are seven federal individual income tax brackets;

The Federal Corporate Income Tax System Is Flat.

Taxable income and filing status determine which federal tax rates apply to.

Tax Plan And Estimate Your Taxes So You Keep More Of Your Money.

Images References :

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T200018 Baseline Distribution of and Federal Taxes, All Tax, Tax rate schedules can help you estimate the amount of tax. Tax filers will need the 2024 federal income tax brackets when they file taxes in 2025.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Shifting Retirement Assets From TaxDeferred To TaxNow By 2026, Estimate your income taxes by tax year. Taxable income and filing status determine which federal tax rates apply to.

Source: www.awesomefintech.com

Source: www.awesomefintech.com

Federal Tax Brackets AwesomeFinTech Blog, Your filing status and taxable income, including wages. On a gross basis, we estimate biden’s fy 2025 budget would increase taxes by about $4.4 trillion over that period.

Source: southarkansassun.com

Source: southarkansassun.com

IRS Unveils 20242025 Tax Season Adjustments with Emphasis on IRS New, Federal income tax rates for tax years 2025, 2026 and 2017 and tax brackets. There are seven tax brackets for most ordinary income for the 2023 tax year:

Source: www.wbir.com

Source: www.wbir.com

IRS new tax brackets don’t apply to 2023 returns, Estimate your income taxes by tax year. Earn up to $18,200 — pay no tax;

Source: digitaloceaninfo.com

Source: digitaloceaninfo.com

IRS Guidelines Unveiled Navigating Federal Tax Brackets, Tax year 2025 tax rates and brackets. The federal corporate income tax system is flat.

Source: imagetou.com

Source: imagetou.com

Tax Rates 2024 2025 Image to u, The expiration of the tax law on dec. How do current federal individual income tax rates and brackets compare historically?

Source: philiswhope.pages.dev

Source: philiswhope.pages.dev

2024 Tax Brackets Single Irs Aura Melita, Individuals with a taxable income of over rs 3 lakh currently have to pay 5% income tax. Taxable income and filing status determine which federal tax rates apply to.

Source: taxrise.com

Source: taxrise.com

How Rising Inflation Can Affect Your Federal Tax Bracket Next Year, Estimate your income taxes by tax year. In 2024, a single taxpayer can claim a federal estate and lifetime gift tax exemption of $13.61 million (twice that for couples making joint gifts).

Source: kessiahwelana.pages.dev

Source: kessiahwelana.pages.dev

How To Calculate Additional Ctc 2024 Irs Abbye Elspeth, You can use our federal tax brackets calculator to determine how much tax you will pay for the current tax year, or to determine how much tax you have paid in previous tax. Changes to marginal tax rates and brackets, itemized deductions, tax exemptions, credits, and other portions of the federal tax system are set to expire at the.

The Federal Corporate Income Tax System Is Flat.

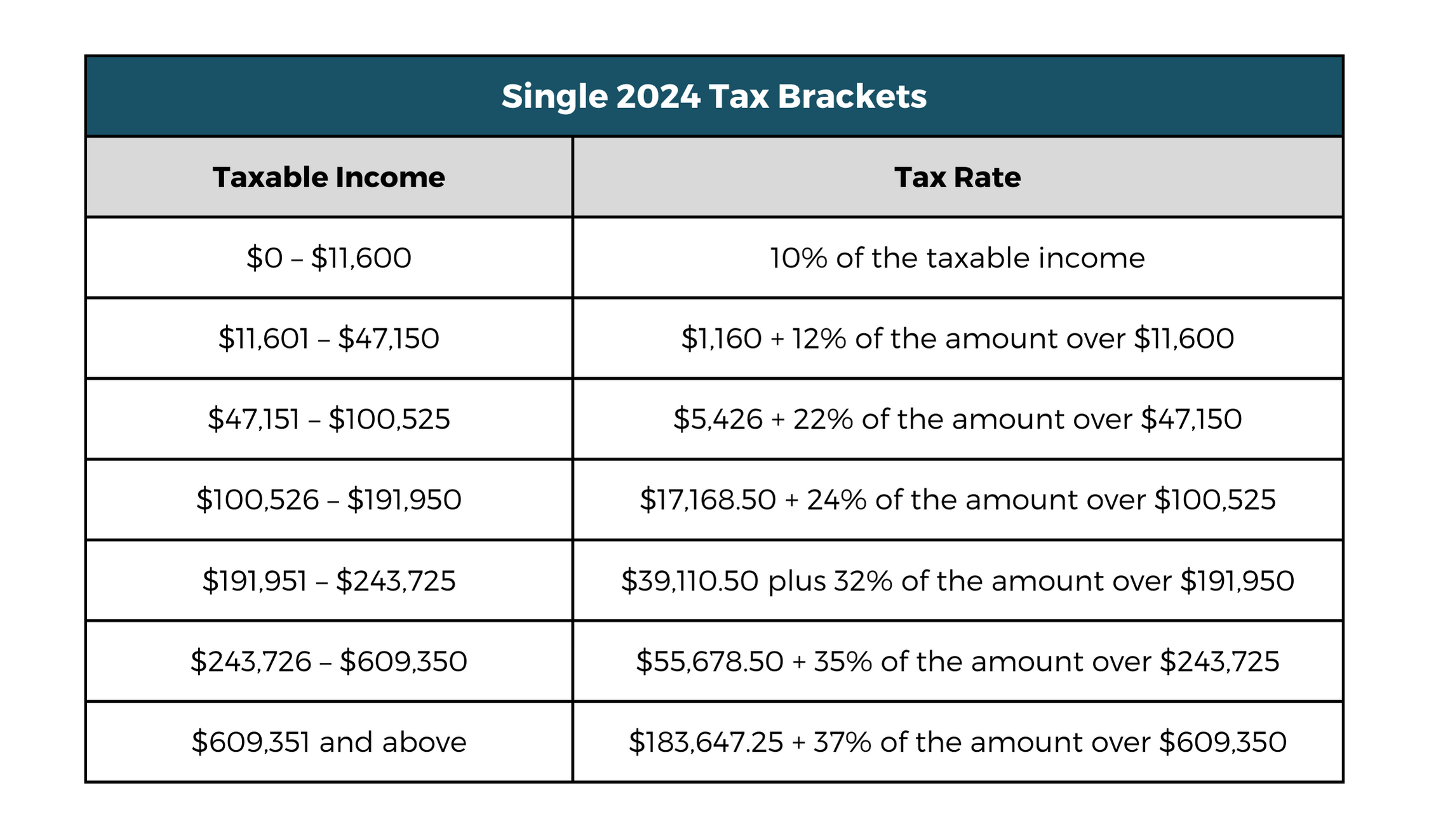

The 2024 tax year, and the return due in 2025, will continue with these seven federal tax brackets:

2024 Tax Brackets (For Taxes Filed In 2025) The Tax Inflation Adjustments For 2024 Rose By 5.4% From 2023 (Which Is Slightly Lower Than The 7.1% Increase The 2023.

10%, 12%, 22%, 24%, 32%, 35% and 37%.